Ohio’s Biennial Budget: Balancing the Needs of Ohioans with Political Will and the State’s Ever-Evolving Revenue Picture

December 3, 2020

December 3, 2020

By Kim Eckhart, KIDS COUNT Project Manager

As the State of Ohio’s budget process develops, leaders have key decisions to make that could significantly impact outcomes for children and families. The pandemic has already affected children in Ohio in significant ways and the repercussions may be felt for years depending on the decisions made by our policymakers in this upcoming biennial budget. One key decision that is often overlooked but may have a larger impact than any other is the revenue forecast. When deciding the funding available for crucial services for children, the budget process starts by using economic data and historical trends to make an educated guess about the amount of revenue available over the next three years. People who are charged with balancing the budget must carefully consider the revenue forecast, because a slight change in the assumptions can mean the difference between budget cuts and budget increases. As an economist and someone who has forecasted revenue for budget offices in my career, I can’t overstate the importance of this step in the process, yet many people focus exclusively on finding ways to modify spending in the budget balancing process.

Revenue forecasts dictate the amount available for children and families for years to come

Lawmakers have a choice to make during this season: They can choose revenue forecasts on the conservative end of the spectrum and enact cuts to programs that could have major impacts on children’s lives. Or, they can choose optimistic forecasts that more heavily weight the role that the economic stimulus packages will have in the future and sustain programs that support children. Choosing a conservative forecast could constrain the appropriation amount in the future. Since there is a cap on appropriation growth, known as the State Appropriation Limit (SAL), any reductions in this biennium will establish new base-line levels. When the economy does rebound, appropriations won’t be able to grow with the increased revenue.

Lawmakers have a choice to make during this season: They can choose revenue forecasts on the conservative end of the spectrum and enact cuts to programs that could have major impacts on children’s lives. Or, they can choose optimistic forecasts that more heavily weight the role that the economic stimulus packages will have in the future and sustain programs that support children. Choosing a conservative forecast could constrain the appropriation amount in the future. Since there is a cap on appropriation growth, known as the State Appropriation Limit (SAL), any reductions in this biennium will establish new base-line levels. When the economy does rebound, appropriations won’t be able to grow with the increased revenue.

The Rainy Day Fund allows for optimistic revenue forecasts amid uncertainty

When revenue is underestimated, there is a surplus at the end of the year that is added to the Budget Stabilization Fund, also known as the Rainy Day Fund. (Overestimates of spending also can result in a surplus). When revenue is overestimated, the default option is to make reductions in spending rather than drawing on these reserves. One exception was in 2009 during the Great Recession when the state biennial budget tapped the Rainy Day Fund. In the 10 years since, the balance has grown to over $2.7 billion dollars. This biennium, choosing a revenue forecast that is on the optimistic end of the spectrum may end up being an overestimate, but it would allow the state to make use of the fund for its intended purpose. The budget stabilization fund is at its ceiling, which means that if revenue forecasts are too conservative, the surplus will not be made available for programs that benefit children and families, but will trigger temporary tax reductions instead.

When revenue is underestimated, there is a surplus at the end of the year that is added to the Budget Stabilization Fund, also known as the Rainy Day Fund. (Overestimates of spending also can result in a surplus). When revenue is overestimated, the default option is to make reductions in spending rather than drawing on these reserves. One exception was in 2009 during the Great Recession when the state biennial budget tapped the Rainy Day Fund. In the 10 years since, the balance has grown to over $2.7 billion dollars. This biennium, choosing a revenue forecast that is on the optimistic end of the spectrum may end up being an overestimate, but it would allow the state to make use of the fund for its intended purpose. The budget stabilization fund is at its ceiling, which means that if revenue forecasts are too conservative, the surplus will not be made available for programs that benefit children and families, but will trigger temporary tax reductions instead.

When are choices about revenue forecasts made during the budget process?

In December, the DeWine Administration will choose from a number of revenue assumptions. As the governor’s economic advisers convene in the coming months, they will weigh many indicators to prepare their baseline. After the budget is introduced in March, the House Finance Committee will compare the governor’s forecast to one prepared by the Legislative Service Commission (LSC). Finally, in May or June, LSC will provide an updated forecast during the Conference Committee, which factor in any new information that has become available in those two months. In the previous budget, the governor made big investments that benefitted children, based partly on optimistic revenue projections. LSC’s more conservative forecast threatened to dismantle those investments. The two revenue forecasts were presented to lawmakers, as described by an article by Karen Kasler in the Statehouse New Bureau. Later, during the Conference Committee, LSC provided a more optimistic picture than the one is prepared in March.

Certainly lawmakers will be faced with the same decision again: a more conservative forecast or an optimistic one. The stakes are high for children. Some may lean toward a conservative forecast over an optimistic one because its description appears to align with their values. But the fuel of our economy is optimism: from consumers, entrepreneurs, business owners making capital investments, and young people as they pursue education and careers. We shouldn’t ask anything less of our lawmakers.

Revenue forecasts are educated guesses that have big impacts

Forecasting revenue relies on being able to predict the future based on the past. It becomes challenging when current circumstances are uniquely different than any other time in our history. The combination of the pandemic and the self-imposed economic shut down for a large number of businesses alongside two large federal stimulus packages, and perhaps a third in the next six months, is unprecedented. The fact is, we have no history to inform the future. Experts are certainly monitoring the monthly revenue and other economic indicators, but predictions about multi-billion dollar shortfalls are simply informed guesses at this point.

Adjusting the states’ expenditures and revenue projections in anticipation of a challenging revenue landscape

Governor DeWine acted quickly this past March once the COVID-19 pandemic was recognized to be a deadly and global threat. The shuttering of schools and restaurants and other businesses was intended to slow down the spread and save lives. Unfortunately this medicine also meant the closing of business, rising unemployment, and the contraction in revenue collections. The steep decline in revenues in April and adjusted revenue forecasts meant that Governor DeWine was forced to enact Executive Order Budget Reductions in the amount of $775 million to keep the state budget balanced by the end of the fiscal year (June 30, 2020). Updated revenue projections estimated the FY2021 shortfall to be $2.43B requiring additional actions to be taken. In additions to the FY 2020 reductions, the Ohio Office of Budget Management refinanced state debt saving another $$363.6million in GRF and implemented a series of cost reduction and spending control measures. Further, the federal government delayed income tax payments by three months pushing these revenues into the FY 2021 fiscal year. Federal stimulus relief in the form of enhanced unemployment payments to individuals and assistance to the states also play a significant role in supporting Ohio’s revenue forecasts. With the declaration of the public health emergency by the Secretary Azar of U.S. Department of Health and Human Services, Ohio qualified for enhanced federal Medicaid assistant payments (E-FMAP). These enhanced payments are essentially an increase in federal payments (6.2 percentage points), which equates to approximately $300M per quarter. Currently, the public health emergency is extended to the end of March, 2021.

What is happening with revenue in the current fiscal year?

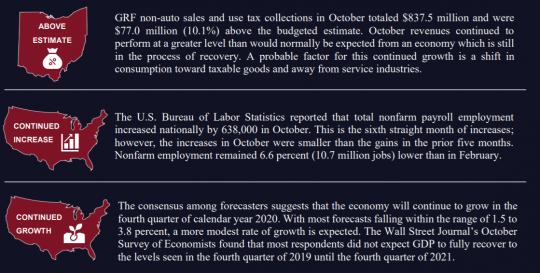

Some indicators show that the economy is rebounding quickly. Others demonstrate the volatility of the ongoing and unprecedented economic disruption caused by a pandemic. The Office of Budget and Management’s October Monthly Financial report provides an overview of these indicators in terms of their budget impact. It reports that total tax revenue in the first 4 months of the fiscal year was $347 million (4%) more than estimated. Sales tax has been $268 million (8%) more than estimated. Surprisingly, during this time of pandemic, it appears that the additional unemployment compensation to individuals may have served as a boon to the state revenue picture as Ohioans as indicated by the increase in sales tax revenues. However, with the expiration of these unemployment payments, Ohio is at risk of experiencing another decline in revenues.

Bottom line: An optimistic revenue forecast in the state budget, combined with a third federal stimulus package, will stimulate the economy and support children and families

Even the most conservative of the economic forecasts, the Wall Street Journal Survey, expects the economy to return to its pre-pandemic level in the first five months of the next biennium. However, all the forecasts rely on a third economic stimulus package. Until there is a vaccine and the state’s economy can fully open up, Ohio will need the federal government to pass another federal stimulus package to provide a revenue lifeline and further protect services and programs for children and families.

Even the most conservative of the economic forecasts, the Wall Street Journal Survey, expects the economy to return to its pre-pandemic level in the first five months of the next biennium. However, all the forecasts rely on a third economic stimulus package. Until there is a vaccine and the state’s economy can fully open up, Ohio will need the federal government to pass another federal stimulus package to provide a revenue lifeline and further protect services and programs for children and families.

An optimistic revenue forecast will serve the role of stimulus package at the state level. If optimism ends up causing revenue to be overestimated, a decade of conservative estimates have provided for that rainy day. Our children have paid the price of the pandemic in so many ways already, let’s not allow them to bear that burden for the next biennium as well.