What Can We Do TODAY to End Child Poverty?

Making the Expanded Child Tax Credit Permanent Will Lift Millions of Children Out of Poverty

In the United States, the wealthiest nation on earth, nearly 1 in 5 children live in poverty. Ohio mirrors these statistics as well. These children often face inadequate health care and nutrition, untreated illness, unsafe child care, unstable housing and inferior schools. CDF believes permitting more than 12.8 million children, 500,000 in Ohio, to live in poverty when we have the means to prevent it is unjust and unacceptable. It is also economically and socially dangerous: child poverty costs our nation nearly $700 billion a year in lost productivity and extra health and crime costs.

In the United States, the wealthiest nation on earth, nearly 1 in 5 children live in poverty. Ohio mirrors these statistics as well. These children often face inadequate health care and nutrition, untreated illness, unsafe child care, unstable housing and inferior schools. CDF believes permitting more than 12.8 million children, 500,000 in Ohio, to live in poverty when we have the means to prevent it is unjust and unacceptable. It is also economically and socially dangerous: child poverty costs our nation nearly $700 billion a year in lost productivity and extra health and crime costs.

For these reasons, the Children’s Defense Fund-Ohio supports making the expanded Child Tax Credit permanent. It is a research-based strategy to dramatically reduce child poverty throughout the United States.

On July 15, 2021, tens of millions of families covering nearly 60 million children across America will begin receiving monthly Child Tax Credit payments

For every child 6-17 years old, eligible families will get up to $250 each month, and for every child under 6 years old, eligible families will get up to $300 each month.

What does this mean?

More than 1.2 million families in Ohio will get a check in July.

Over $550 million for Ohio families to help 2.1 million children thrive.

According to a report published by the Center for Budget and Policy Priorities in March 2021, the expanded CTC will lift 132,000 children under the age of 18 out of poverty.

The American Rescue Plan provides the largest ever Child Tax Credit as a way of recognizing that raising children is expensive and providing for the wellbeing is in the public interest. Families will receive $3,000-$3,600 per child. All working families will get the full credit if they make up to $150,000 for a couple

or $112,500 for a family with a single parent (also called Head of Household).

The expanded Child Tax Credit is a major step forward in tackling child poverty. Prior to the American Rescue Plan, low-income families often got a smaller child tax credit than families with higher earnings. Now, the families of over 26 million children will get the full, expanded credit.

To learn more, visit ChildTaxCredit.gov or the Children’s Defense Fund’s Direct Advocacy Hub. Let’s make this permanent!

Learn More About Accessing the Child Tax Credit

Federal legislation made significant changes to the Child Tax Credit for the 2021 tax filing. These changes will impact most Ohio families by providing much needed relief to help families meet their basic needs.

Webinar: Get That Money! Ensuring Ohio families know about and can access their tax credits

Webinar: Get That Money! Ensuring Ohio families know about and can access their tax credits

March 16, 2022

This webinar covers the importance and impact of the Child Tax Credit in Ohio and provides an overview of the changes to the Child Tax Credit and eligibility, as well as how to access or help others access the credits that families are entitled to. We and our partners also discuss changes to the Earned Income Tax Credit and the Child & Dependent Care Credit, and we share the various online tools, guidance, and resources available to help spread the word on the Child Tax Credit to more Ohio families.

Featured Panelists:

- Katherine Ungar, Policy Associate, Children’s Defense Fund-Ohio

- Will Petrik, State Budget Researcher, Policy Matters Ohio

- Courtney O’Reilly, Senior Program Manager, Tax Benefits, Code for America

- Jason Carter, Child Tax Credit Advocate

Featured Resources:

- Get Your Refund: Free Tax Filing and Assistance from IRS-Certified Volunteers

- Get that money now: Expanded tax credits can help families meet their basic needs and thrive

- Get Your Refund Outreach and Navigator Resources

- Earned Income Tax Credit Estimator

- CDCTC Calculator: How Much Could You Receive?

- Child Tax Credit Social Media Toolkit & Outreach Materials for 2022

Download PPT Slides from Webinar Here.

3.7 million more kids are in poverty without the monthly Child Tax Credit, study says

Child Tax Credit is Helping Ohio Children go to School Fed, Healthy, and Ready to Learn

November 8, 2021

By Megan Cremeans, Law School Extern

Moritz College of Law at the Ohio State University

I student-taught with a truly extraordinary teacher, Marc, who kept a desk drawer full of snacks and fresh fruit on his desk. If a student asked for food, he gave it freely. He never interrogated their need nor desire, and he always offered anything he could. Marc is a unique and gifted educator, but he is not the first teacher I have met who goes out of their way to ensure a student is fed, and after a short time with him, I also picked up the habit of keeping extra snacks around for anyone who asked. Marc, like many educators, understands that nutrition is essential to child learning and development and that a child who is hungry cannot meet their full potential.

Educators see firsthand how their students, at no fault of their own, are denied equitable opportunities to thrive in their classrooms due to hunger and the lack of a social safety net to ensure all families with children are supported to afford necessities like food. Childhood hunger is pervasive in the United States – but what has given many Americans hope, especially current and former teachers, is the potential for a permanently expanded Child Tax Credit (CTC) that, if passed, could help ensure students focus less on their empty stomachs and more on enriching educational experiences.

In 2016, Children’s Defense Fund-Ohio’s issue brief on early childhood hunger detailed the substantial impacts on health that thousands of Ohio’s youngest children suffer from every day. Food insecure children are more likely to be behind in social skills and reading performance in kindergarten. By elementary school, they are four times more likely to need mental health counseling. The longer food insecurity persists, the more severe the consequences are on a child’s long-term well-being. Malnutrition from childhood food insecurity has been linked to adult diseases, including diabetes, hyperlipidemia, and cardiovascular disease. The stress and anxiety of early childhood hunger also makes it harder to learn skills that help later relationship development, school success, and workplace productivity.

Feeding America reports 1,547,110 Ohioans are facing hunger – nearly three for every ten are children. Statewide, roughly one in six children do not have their nutritional needs met. Moreover, because of the ongoing COVID-19 pandemic, Ohioans are increasingly faced with food insecurities that leave their children hungry and at risk for health concerns. The Child Tax Credit (CTC) payments are one way in which families are addressing the needs of their kids and putting food on the table.

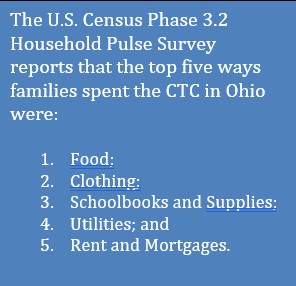

Many families, not just those facing food insecurity, are using the CTC payments to support the well-being of their children in a variety of ways: some households report mostly spending the payments, while others have elected ways to save it or use it to pay off debts.

Data from the U.S. Census Phase 3.2 Household Pulse Survey reports that those households mostly spending their CTC payments, rather than saving it or paying off debt, are those households who make less than $50,000 annually. On average 197,311 households who make less than 50,000 annually reported mostly spending their CTC payments.

Almost 375,000 recipients reported spending their CTC payment mostly on food. The CTC payments are instrumental in decreasing childhood hunger. When families can spend more on food, less families are faced with food insecurities and more children are freed from the risks that come from hunger. After just a little over a month of CTC payments, families nationwide reported more full bellies: nationwide, the number of adults living with children reporting that their household didn’t have enough to eat fell by 3.3 million or nearly one-third. The steep decline in food hardship reported by parents directly follows the issuance of the first monthly CTC payment on July 15.

Not only is the CTC allowing families to keep food on the table, but it is providing families with a unique opportunity to pay off debt. A slight majority of families have used the CTC payments to pay off debts. Debt can saddle a family with a heavy burden—interest only makes that burden increasingly troublesome. Studies that examine parental debt and children’s socioeconomic well-being prove that certain kinds of debt, like a home mortgage, lead to greater emotional well-being for children. Higher levels of and increases in unsecured (e.g. credit card) debts were associated with lower levels of and declines in child socioemotional wellbeing. When families can pay off debt, they can reduce the interest accrued, improve their credit scores, focus more on other financial

goals, and ease the mental load of having that debt. This financial freedom allows families to better meet the needs of their children.

The Child Tax Credit is set for expansion with the passage of the Build Back Better proposal. If passed, the CTC payments would be expanded from $2,000 to $3,000 per child six years-old and above, and to $3,600 per child under six. The Build Back Better proposal makes the credit fully refundable on a permanent basis, so that low-income families can benefit from the full tax credit. Combined, these tools allow greater access for families in poverty as a tangible long-term solution to end childhood hunger.

When I think back to all the desk-drawers full of snacks and all the teachers who dole them out day-by-day, I cannot fathom why the richest industrialized nation in the world would allow such a broken social safety net to persist when a simple, sound policy solution such as the CTC has shown positive impacts for bolstering families in other countries for decades. We can see the positive results that just a few months of payments are already having on families and their ability to be food secure. While unprecedented numbers of children are experiencing hunger still in this moment, we must ensure these payments continue. A child’s physical and mental health depend on getting enough nutrients each day and it’s our societal obligation to ensure families, who take on the hard work every day to raise their children, can meet those needs.

The deadline for non-filer sign-up through the GetCTC.org/CTCOH simplified tool is quickly approaching. Most Ohio families qualify for the expanded child tax credit. If an eligible family filed taxes in 2020 or 2019 or used the non-filer online portal to receive stimulus payments, they should automatically receive their payments without taking any further action. Families who did not file taxes in the last two years or register for the stimulus payments need to use theGetCTC.org/CTCOH non-filer portal to claim their CTC payments before November 15th!

Children’s Defense Fund-Ohio thanks Share our Strengths for their generous support of our efforts and that of our partner organizations that have committed to conduct outreach to families with children to enroll in the Child Tax Credit. For more information about the Child Tax Credit, please contact Katherine Ungar, Policy Associate at kungarl@childrensdefense.org.

Download this article as a PDF

Learn more about Child Tax Credit

On August 16, 2021, CDF-Ohio partnered with Children’s Defense Fund, the Center for the Study of Social Policy (CSSP), the Ohio Organizing Coalition, the Southeast Ohio Legal Aid Services, and HAPCAP on a webinar to share more about the Child Tax Credit, how families can access the benefit, and why it’s important to make this permanent.

View the webinar recording here.

For more information about Child Tax Credit, check out these resources:

About the American Rescue Plan’s Child Tax Credit:

- CDF: Understanding the Expanded Child Tax Credit

- Download flyers to share with your colleagues here.

Where Families Can Go for Free Tax Help:

- IRS Volunteer Income Tax Assistance (VITA) and Tax Counseling for the Elderly (TCE) Programs: Find one near you here

- Local legal services organizations and/or Low Income Taxpayer Clinics (LITCs)

- GetYourRefund.org, an initiative of Code for America (English and Spanish)

- IRS Free File programs for families with incomes below $72,000

- White House: www.childtaxcredit.gov

- IRS: https://www.irs.gov/credits-deductions/advance-child-tax-credit-payments-in-2021

- IRS Technical FAQs: https://www.irs.gov/credits-deductions/2021-child-tax-credit-and-advance-child-tax-credit-payments-frequently-asked-questions

- Get it back: What’s New About the Child Tax Credit in 2021? https://www.taxoutreach.org/tax-credits/child-tax-credit/whats-new-about-the-child-tax-credit-in-2021/

- Non-filer Sign-up Tool: https://www.irs.gov/credits-deductions/child-tax-credit-non-filer-sign-up-tool

Join the Automatic Benefit for Children (ABC) coalition co-chaired by the Children’s Defense Fund and the Center for the Study of Social Policy (CSSP)

- Mission: Our mission is to create a child allowance, or a guaranteed minimum income for children, that provides regular, meaningful assistance to families, promotes racial equity and justice, enjoys broad public support, and serves as a foundation for a more equitable and inclusive social support system.

- Sign up: https://docs.google.com/forms/d/e/1FAIpQLScNAxcCBZQnSAeXBSaaNRWkJpzzLPD559eS5FOKcFramf4hbg/viewform

- Use our Direct Advocacy Form: https://www.childrensdefense.org/ctc-advocacy-hub/

Report: U.S. Can Lift 5.5. Million Children Out of Poverty Right Now

The Children’s Defense Fund’s new edition of our Ending Child Poverty Now report shows our nation can help millions of today’s children escape poverty now by simply improving and investing in existing policies and programs to increase employment, make work pay and meet children’s basic needs. By investing an additional 1.4 percent of the federal budget into these proven policies and programs, our nation can reduce child poverty at least 57 percent, lift 5.5 million …read more

The Children’s Defense Fund’s new edition of our Ending Child Poverty Now report shows our nation can help millions of today’s children escape poverty now by simply improving and investing in existing policies and programs to increase employment, make work pay and meet children’s basic needs. By investing an additional 1.4 percent of the federal budget into these proven policies and programs, our nation can reduce child poverty at least 57 percent, lift 5.5 million …read more

| Child Poverty Statistics | Ohio | United States |

|---|---|---|

| Children in poverty | 20% | 18% |

| Children ages 0 to 5 in poverty | 23% | 20% |

| Black or African American children ages 0 to 5 in poverty | 48% | 37% |

| Hispanic or Latino children ages 0 to 5 in poverty | 39% | 28% |

| Non-Hispanic White children ages 0 to 5 in poverty | 16% | 12% |

| Children receiving food assistance | 1 in 3 | 1 in 4 |

| Children whose parents lack secure employment | 28% | 27% |

| Black or African American children whose parents lack secure employment | 47% | 42% |

| Hispanic or Latino children whose parents lack secure employment | 40% | 32% |

| Non-Hispanic White children whose parents lack secure employment | 23% | 21% |

Our vision

Today, more children in Ohio live in poverty than did before the Great Recession began in 2008. An unacceptable number of Ohio children are also growing up in low-income working families. A disproportionate number are Black and Latino. Poor children often lag behind their peers in many ways beyond income: They are often less healthy, can trail in emotional and intellectual development, and are less likely to graduate from high school. Poor children are more likely to become poor parents. Every year we let children live in poverty, it costs our nation half a trillion dollars in lost productivity and increased health and crime costs.

Our vision is to end child poverty. We must ensure all parents and caregivers have the resources to support and nurture their children: jobs with livable wages, affordable high-quality child care, supports for working families like the Earned Income Tax Credit and the Child Tax Credit, and safety nets for basic needs like nutrition and housing assistance. We must also ensure every child in Ohio has access to high-quality early childhood development and learning, comprehensive health coverage and care, and quality K-12 education so all children can reach their full potential.

Our work

In our annual Annie E. Casey Foundation KIDS COUNT reports, we detail how Ohio children are doing on a variety of child well-being indicators, including poverty. Our KIDS COUNT data shows how children of color and children in Ohio’s Appalachian and rural counties suffer disproportionately from the effects of poverty.

Explore other Policy Priorities